!! Commencal Bikes Sale Ending Soon !!

Workshop Closed For A Refurb From 11Dec-5th Jan

Fiido Bikes UK Partner

.

.

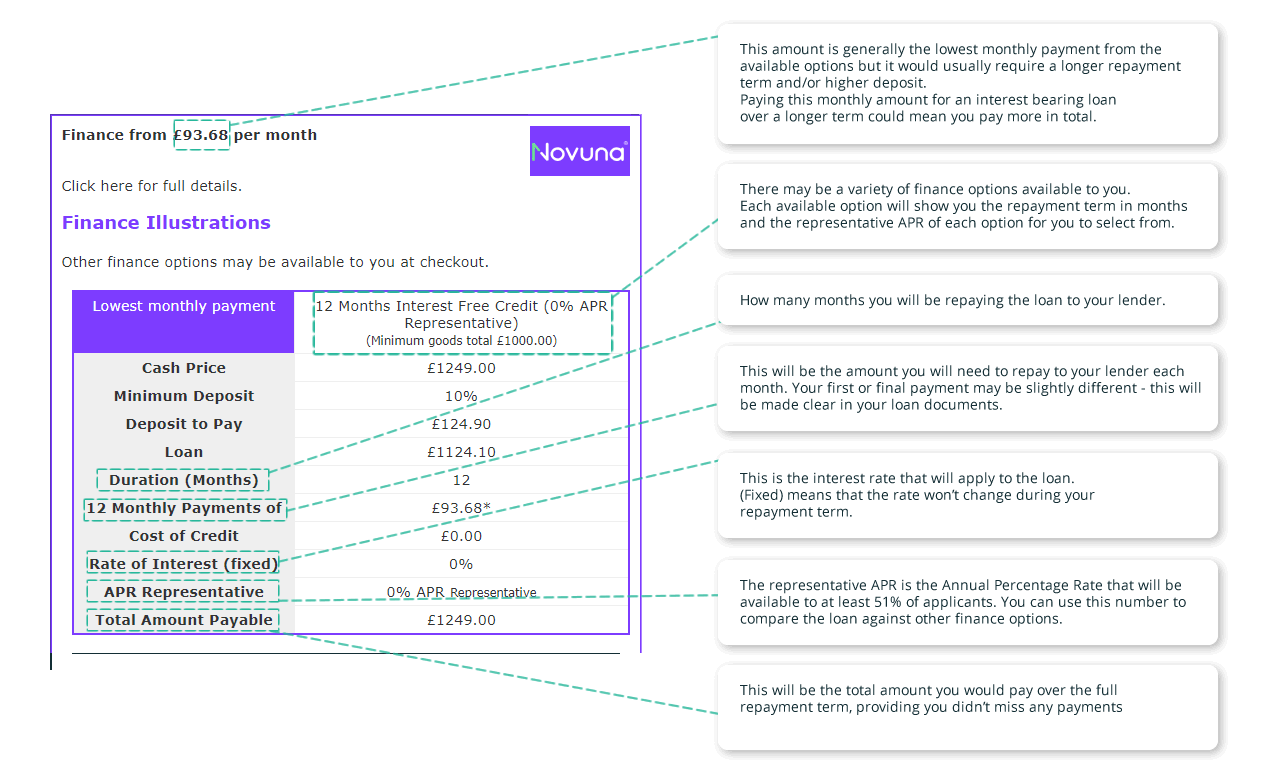

| 10 Months Interest Free Credit (0% APR Representative) (Minimum goods total £900.00) | |

| Goods Total | £1600.00 |

| Minimum Deposit | 10% |

| Deposit Total | £160.00 |

| Loan | £1440.00 |

| Duration (Months) | 10 |

| 10 Monthly Payments of | £144.00* |

| Cost of Credit | £0.00 |

| Rate of Interest (fixed) | 0% |

| Representative APR | 0% APR Representative |

| Total Amount Payable | £1600.00 |